Malaysia Custom Tax: A Comprehensive Guide to Importing from China

When it comes to importing goods from China to Malaysia, navigating the complexities of Malaysia custom tax can be a daunting task. This guide aims to break down the process, making it more accessible and easier to understand. With the help of CIEF Worldwide Sdn Bhd, a trusted logistics partner, you’ll be well on your way to a successful importing venture.

A Brief Overview of Malaysia Custom Tax

Malaysia imposes custom tax on imported goods to regulate trade, protect local industries, and generate revenue for the government. The tax rates and regulations vary depending on the type of goods and the specific circumstances of the importer. Here are the key components of Malaysia custom tax you need to be aware of:

Import Duty

Import duty is a tax levied on imported goods, based on their Harmonized System (HS) code. The rates differ depending on the category of goods, ranging from 0% to 30%. Some items may be exempt from import duty or eligible for preferential rates under trade agreements.

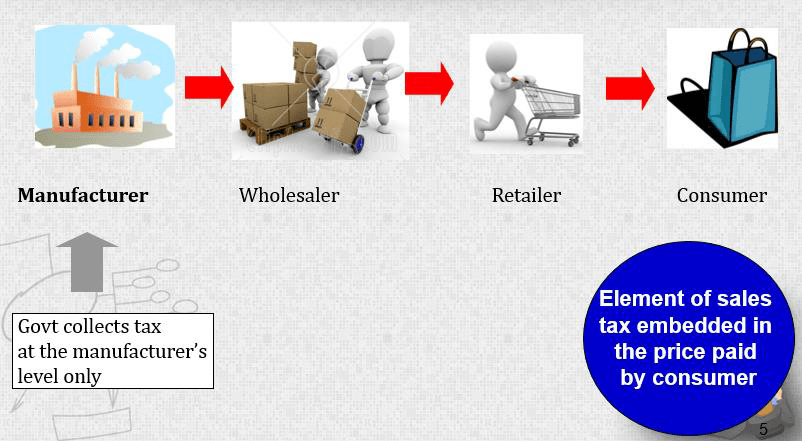

Sales and Service Tax (SST)

SST is a consumption tax levied on goods and services in Malaysia. Imported goods are subject to the Sales Tax, typically ranging from 5% to 10%, while certain services may be subject to the Service Tax at 6%. Some goods and services are exempt from SST.

Customs Value

The customs value of imported goods is the basis for calculating import duty and SST. It usually includes the transaction value, cost of transportation, insurance, and any other charges incurred up to the point of importation.

Step-by-Step Guide to Importing from China to Malaysia

Step 1: Identify Your Goods and Their HS Code

Before importing, you must determine the HS code for your goods. This is a standardized international classification system used to determine import duty rates and other regulations. You can search for your product’s HS code on the Royal Malaysian Customs Department website or consult with a customs broker or logistics expert like CIEF Worldwide Sdn Bhd for assistance.

Step 2: Determine Import Duty and SST Rates

Once you have identified the HS code, you can find the applicable import duty and SST rates. Make sure to factor in any exemptions or preferential rates that may apply to your goods. This information is crucial for budgeting and pricing your imported products.

Step 3: Choose a Reliable Logistics Partner

Having a reliable logistics partner like CIEF Worldwide Sdn Bhd is essential for smooth importation. They offer a range of services tailored to small and medium-sized companies, including sea and air shipping LCL, money transfer solutions, and full container services for sea shipments. With their extensive experience and knowledge, they can help guide you through the import process and ensure your goods arrive safely and on time.

Step 4: Prepare Required Import Documents

To import goods into Malaysia, you need to prepare various documents, including:

- Commercial Invoice

- Bill of Lading or Air Waybill

- Packing List

- Certificate of Origin (if applicable)

- Import Permit or License (if required)

Your logistics partner can help you obtain and prepare these documents, ensuring compliance with customs regulations.

Step 5: Arrange Customs Clearance

Upon arrival of your goods in Malaysia, you or your logistics partner must declare the goods to customs by submitting the necessary import documents and paying the required custom tax. CIEF Worldwide Sdn Bhd can handle customs clearance on your behalf, ensuring a hassle-free experience.

Step 6: Arrange Transportation and Delivery

After clearing customs, your goods can be transported to their final destination. CIEF Worldwide Sdn Bhd offers door-to-door delivery services, making the process seamless and efficient.

How CIEF Worldwide Sdn Bhd Can Make a Difference in Your Importing Journey

Navigating Malaysia’s custom tax system can be challenging, but CIEF Worldwide Sdn Bhd is here to help. Their expertise in logistics and importing makes them an invaluable partner for small and medium-sized businesses looking to import goods from China. Here’s how they can help streamline your importing process:

Sea and Air Shipping LCL Services

CIEF Worldwide Sdn.Bhd offers Less than Container Load (LCL) services for both sea and air shipments, perfect for businesses that don’t need a full container. Their consolidation services allow you to combine smaller parcels into one bulk shipment, reducing shipping costs. They also handle door-to-door delivery and customs clearance, making the process more straightforward.

Their two sorting center warehouses in Guangzhou and Yiwu are strategically located to save on China inland transport costs, providing a unique selling point that sets them apart from competitors.

Money Transfer Solution

CIEF Worldwide Sdn Bhd provides a convenient solution for transferring funds between Malaysia and China, helping you avoid issues with income tax and audit firms. They offer two transfer methods: China Bank Transfer and Payment to the 1688 Platform Order. Their services include a 24-hour money-back guarantee and a legitimate local invoice for accounting purposes. They also consult with customers to choose the most cost-efficient and legal payment option.

Full Container Service

For businesses that require a full container load, CIEF Worldwide Sdn Bhd offers comprehensive services. They assist with checking product HS codes and optimizing them to reduce costs significantly. They also advise customers on obtaining import licenses, such as SIRIM or CIDB, and help them import their products smoothly using the full container load method. Furthermore, they provide cost comparisons between LCL and FCL in special cases.

Conclusion

Understanding Malaysia’s custom tax system is essential for businesses looking to import goods from China. By following the step-by-step guide outlined above and partnering with an experienced logistics provider like CIEF Worldwide Sdn Bhd, you can navigate the complexities of importation and ensure a smooth, successful experience.

With their wide range of services, including sea and air shipping LCL, money transfer solutions, and full container services, CIEF Worldwide Sdn Bhd is well-equipped to handle all aspects of the importing process. Their expertise in customs regulations and logistics ensures that your goods will arrive safely and on time, allowing you to focus on growing your business.

So, if you’re looking to import goods from China to Malaysia, make sure to consider CIEF Worldwide Sdn Bhd as your logistics partner. Their experience and knowledge in navigating Malaysia’s custom tax system will help make your importing journey seamless and successful.