Navigating HS Codes: A Guide to Smooth Imports from China to Malaysia

When it comes to importing goods from China to Malaysia, understanding the intricacies of Malaysia Custom Tax is essential. In this article, we will delve into the world of customs taxes, HS Codes, and the necessary steps you need to take for a smooth import process. We’ll also highlight the benefits of partnering with a reliable logistics company like CIEF Worldwide Sdn Bhd.

The Importance of HS Codes

HS Codes (Harmonized System Codes) are a global classification system used to identify products and calculate custom duties. They play a crucial role in the importing process, as they determine the taxes you’ll have to pay. Hence, it’s vital to correctly identify the HS Code for your goods.

Finding the Right HS Code

There are two primary methods for obtaining the correct HS Code for your products:

Method 1: Consult Your Logistics Provider

Reputable logistics providers like CIEF Worldwide Sdn Bhd can assist you in determining the appropriate HS Code for your products. If you’re using their Full-Container Load (FCL) service, they’ll handle the customs clearance process on your behalf. All you need to do is provide them with the necessary details about your goods.

To get started, visit the CIEF official website and fill out the FCL price form with your name and contact number. CIEF’s customer service will then contact you and provide a comprehensive proposal for your FCL importing needs.

Method 2: Self-inquiry on the Royal Malaysian Customs Department Portal

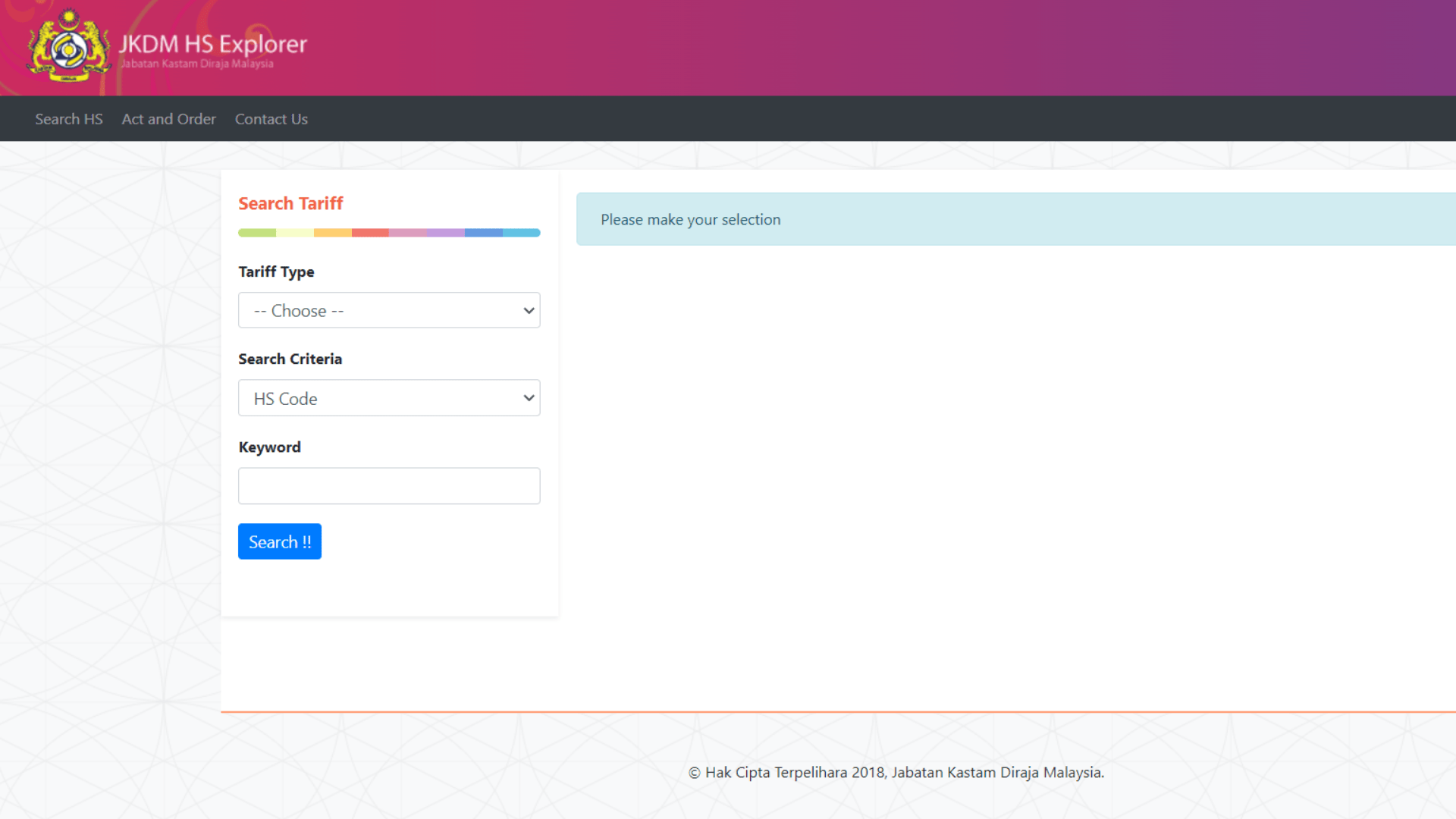

While Google can offer some assistance in determining HS Codes, a more accurate source is the official portal of the Royal Malaysian Customs Department. However, note that the HS Codes listed on the website are for reference only and may not be entirely accurate. For guaranteed accuracy, it’s best to consult CIEF or another reliable logistics provider.

To search for HS Codes on the Royal Malaysian Customs Department portal, follow these steps:

- Visit the official portal of the Royal Malaysian Customs Department.

- Use “PDK 2017” to search for taxes. You’ll need the first four digits of your product’s HS Code, which can be obtained through a Google search. For example, if you’re importing purses, the first four digits of the HS Code are 4202.

- Enter the required details and click “Search” to find the corresponding HS Code.

Remember, the HS Codes found through this method are for reference only, and consulting a logistics provider like CIEF is always recommended.

Navigating Malaysia Custom Tax: Import Duty and SST

As an importer, it’s essential to be aware of the import duties and SST (Sales and Service Tax) that you’ll need to pay when importing goods from China to Malaysia. In our next article, we’ll provide a step-by-step tutorial on how to determine the corresponding import tariff for your goods.

Ready to start importing from China to Malaysia? CIEF Worldwide Sdn Bhd offers a range of services to simplify the process, including air and sea shipping, parcel consolidation, and full container load services. Visit their website to learn more:

- CIEF Sea Shipping Services

- CIEF Full Container Load (FCL)

- CIEF LITE Parcel Consolidation

- CIEF Exchange System