The TT Payment Game Changer: Reinventing Malaysia-to-China Money Transfers

Telegraphic transfers, commonly abbreviated as T/T, are an essential component of global finance. As businesses thrive in an interconnected world, secure and efficient methods of transferring funds internationally become increasingly important. This article aims to break down telegraphic transfers, making them accessible and easy to understand while showcasing their role in the import process from China to Malaysia. To create an engaging narrative, we’ll use real-life examples and a storytelling approach.

Telegraphic Transfer: A Brief Introduction

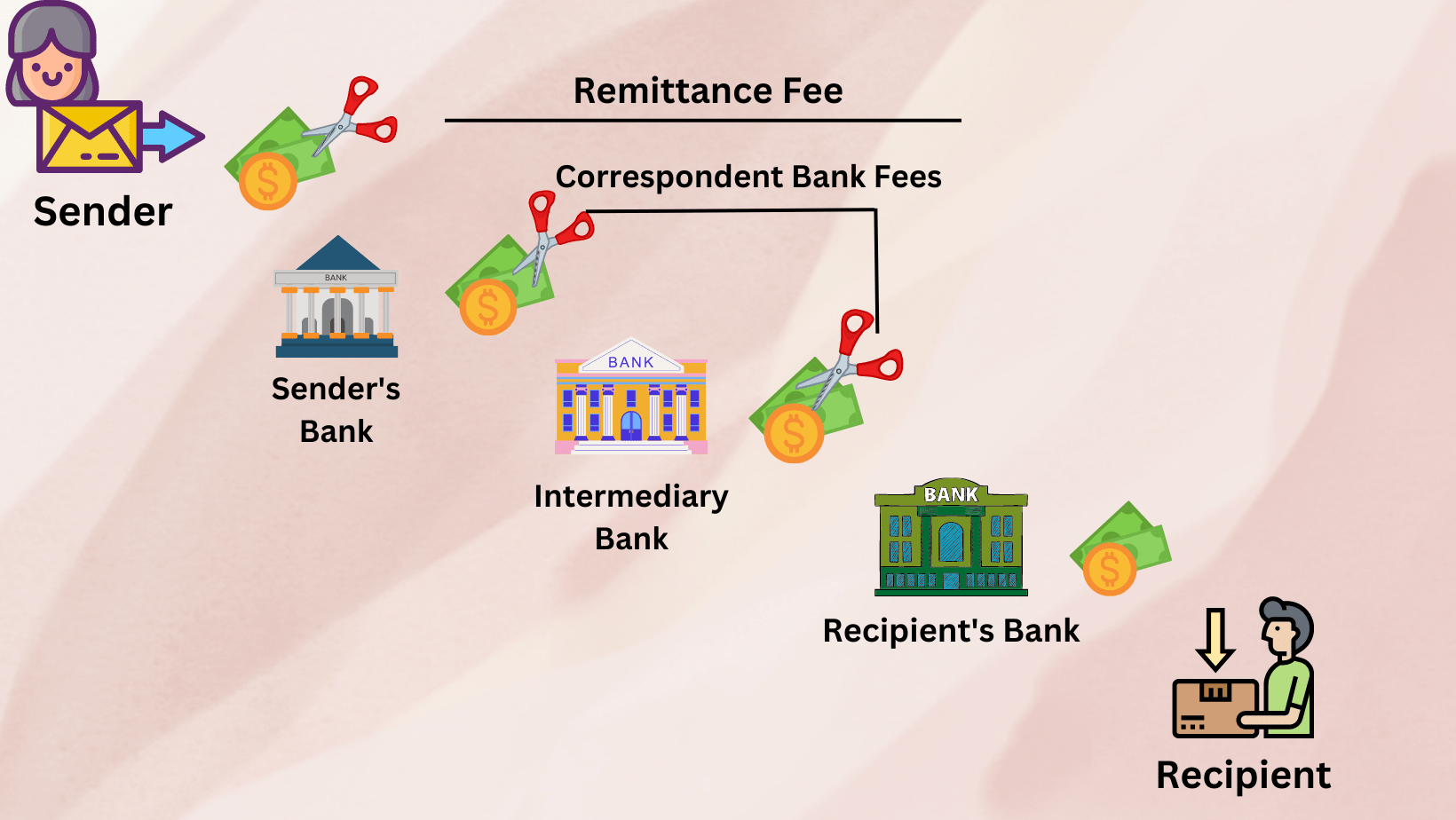

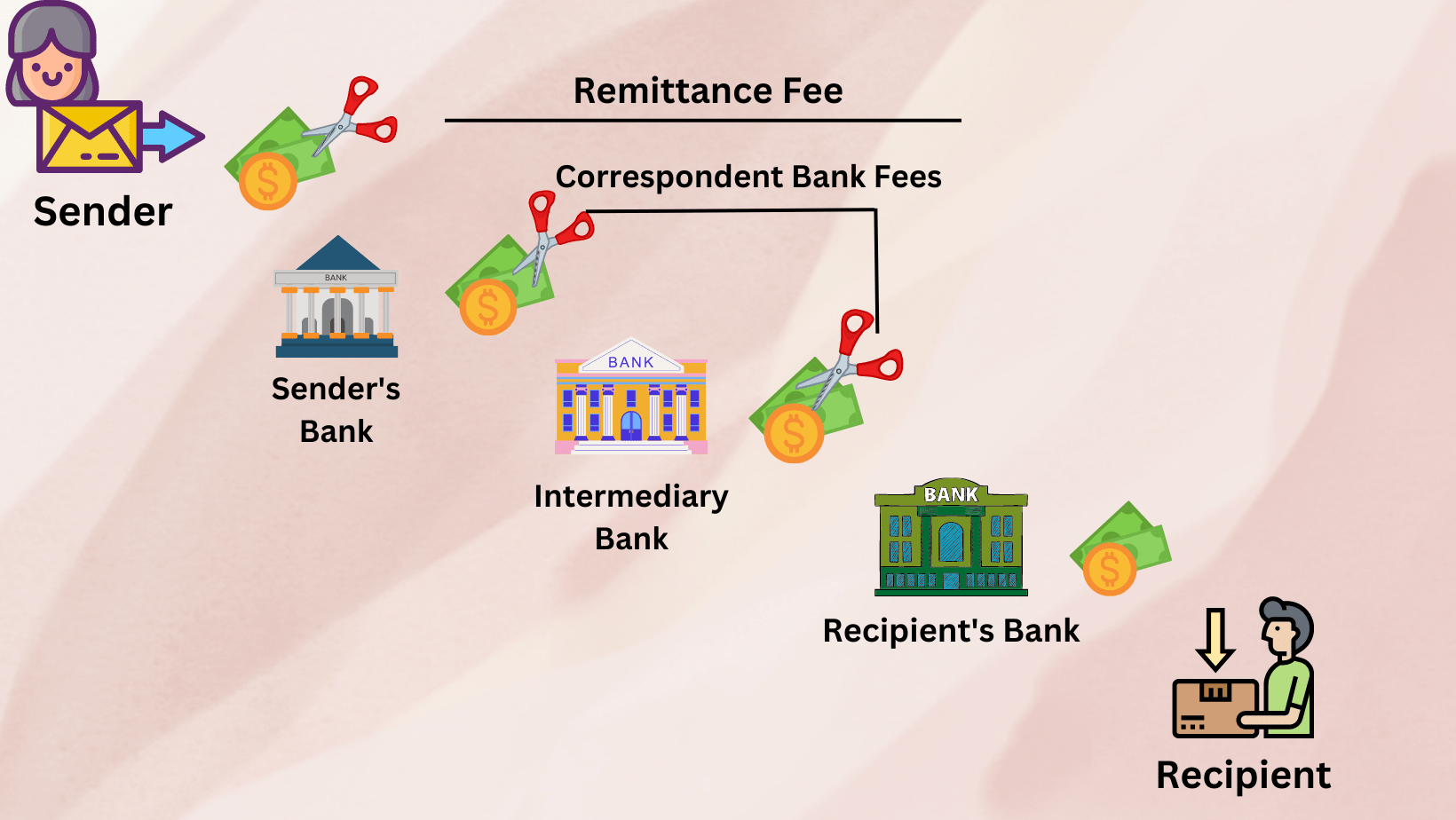

A telegraphic transfer is an electronic method for transferring funds from one bank account to another, either domestically or internationally. The term “telegraphic transfer” harkens back to the era when telegraph communications were the primary means of sending instructions for fund transfers. Nowadays, however, telegraphic transfers occur through secure online banking systems and the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network.

Telegraphic Transfer’s Role in Importing from China to Malaysia

When considering the import process from China to Malaysia, various factors come into play, such as logistics, customs clearance, and payment methods. Telegraphic transfer plays a vital role, ensuring the safe and efficient transfer of funds to suppliers in China.

CIEF Worldwide Sdn Bhd: Your Go-to Logistics Partner

CIEF Worldwide Sdn Bhd is a leading logistics company that specializes in offering comprehensive solutions for small and medium-sized enterprises in Malaysia that regularly purchase goods from China. Their range of services includes sea shipping LCL (Less than Container Load), air shipping LCL, full container load (FCL) for sea shipment, and money transfer solutions. Additionally, they provide educational resources to assist customers in placing shipping orders and selecting the most appropriate shipping method.

The Step-by-Step Guide to Importing from China to Malaysia

Step 1: Locate Trustworthy Suppliers

The first step in importing goods from China to Malaysia is identifying dependable suppliers offering high-quality products at competitive prices. Potential suppliers can be found on popular online platforms like Alibaba and 1688, or by attending trade shows and exhibitions.

Step 2: Negotiate Terms and Prices

After identifying suitable suppliers, negotiate the terms and prices of the deal. Clarify the payment method, delivery time, and any extra charges during this stage. Keep in mind that many Chinese suppliers prefer telegraphic transfers as a secure and swift method for receiving funds.

Step 3: Place Your Order and Make a Payment

Upon finalizing the agreement with the supplier, place your order and make a payment using telegraphic transfer. When working with a new supplier, it is advisable to pay a deposit first and cover the remaining balance once the goods are ready for shipment.

CIEF Worldwide Sdn Bhd provides a money transfer solution, allowing customers to make payments for their 1688 platform orders without the worry of a frozen bank account. They offer a 24-hour money-back guarantee and a legitimate local invoice for customer accounting purposes.

Step 4: Organize Shipping and Logistics

Shipping and logistics are integral aspects of importing goods from China to Malaysia. CIEF Worldwide Sdn Bhd offers sea shipping LCL, air shipping LCL, and full container load (FCL) services for sea shipments. They also provide door-to-door delivery and customs clearance, ensuring customers are not burdened with additional taxes.

CIEF Worldwide Sdn Bhd provides two types of sea shipping LCL services:

- Small Parcel with Consolidate Function: Customers can purchase goods in small parcels and consolidate them into a single bulk shipment to reduce costs.

- Big Parcel: This method does not include a consolidation function but offers faster delivery times and lower shipping costs.

CIEF Worldwide Sdn Bhd offers two types of air shipping LCL services:

- Small Parcel with Consolidate Function: Similar to sea shipping, customers can purchase goods in small parcels and consolidate them into a single bulk shipment to reduce costs.

- Big Parcel: This method does not include a consolidation function but provides faster delivery times and lower shipping costs.

Both air shipping LCL services come with door-to-door delivery and customs clearance, ensuring customers are not burdened with additional taxes.

Step 5: Customs Clearance and Import Licenses

To import goods into Malaysia, proper customs clearance and import licenses are required. CIEF Worldwide Sdn Bhd provides educational resources to help customers check their product HScode and optimize it to reduce costs significantly. They advise customers on obtaining import licenses, such as SIRIM or CIDB, and help them import their products smoothly using the full container load method.

Step 6: Receive Your Goods

Once the goods have cleared customs, they will be delivered to your designated location. Upon receiving your shipment, inspect the goods to ensure they meet your expectations and report any discrepancies to the supplier promptly.

Alternative Payment Methods for Suppliers Who Cannot Receive Telegraphic Transfers

In some instances, suppliers in China may be unable to receive funds through telegraphic transfers. They might prefer to receive payments in their personal accounts within China or directly on the 1688.com platform. In such scenarios, traditional telegraphic transfers may not be an appropriate payment option. However, CIEF Worldwide Sdn Bhd’s Exchange service offers a solution to this problem.

Exchange Service by CIEF Worldwide Sdn Bhd

CIEF Worldwide Sdn Bhd’s Exchange service caters to the diverse payment preferences of suppliers in China. This service allows customers to transfer RMB to a supplier’s personal or company account securely and efficiently. Additionally, it supports transfers in USD and provides a 100% secure way to make payments on behalf of customers on the 1688.com platform, with a 0% account freezing risk.

By offering these alternative payment methods, CIEF Worldwide Sdn Bhd ensures that Malaysian businesses can seamlessly import goods from China without any payment-related bottlenecks. The Exchange service adds another layer of convenience and security to the entire importing process, making it even easier for small and medium-sized companies in Malaysia to work with Chinese suppliers.

Offering Local Invoices for Accounting Purposes

One of the standout features of CIEF Worldwide Sdn Bhd’s Exchange service is its ability to provide Malaysian businesses with local invoices for accounting purposes. Proper documentation is essential when conducting international transactions, as it helps maintain transparency and accountability.

By offering legitimate local invoices, CIEF’s Exchange system ensures that Malaysian businesses can accurately record their transactions and maintain proper financial records. This not only aids in complying with local accounting standards but also assists companies in avoiding potential legal issues arising from improper documentation.

In summary, the CIEF Exchange system not only provides a seamless and secure alternative payment method for dealing with suppliers in China but also supports Malaysian businesses by offering local invoices, further streamlining the import process from China to Malaysia.

Wrapping Up

Telegraphic transfers remain a popular and secure method for international money transfers. However, when dealing with suppliers who cannot receive funds through telegraphic transfers, CIEF Worldwide Sdn Bhd’s Exchange service offers a reliable alternative that ensures smooth transactions and successful imports from China to Malaysia. By leveraging their comprehensive logistics and payment solutions, businesses in Malaysia can thrive in the competitive world of international trade.