1688 Payment

To solve payment challenges when purchasing from 1688, CIEF offers a dedicated sub-account payment service, allowing you to place and pay for orders without needing an Alipay account.

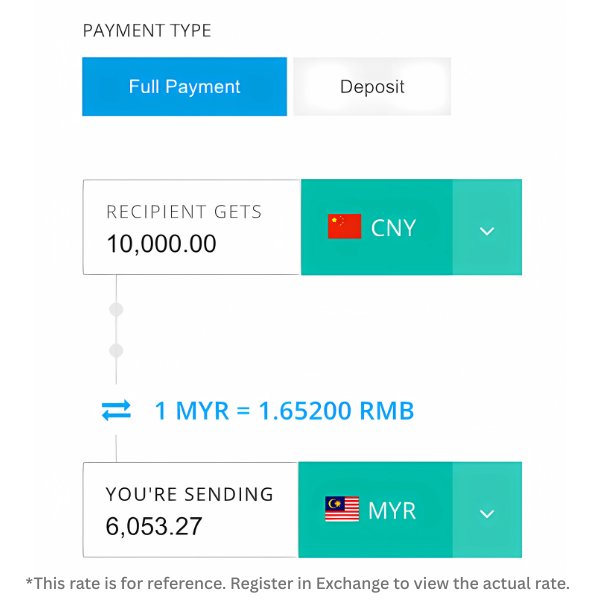

We will provide you with a dedicated 1688 sub-account to browse, add items, and create orders. Once the order is confirmed, we will process the payment through our 1688 main account. You simply need to make the payment to us in MYR (Malaysian Ringgit).

This service offers the following advantages:

• No Alipay or bank card required

• Avoid risk of account frozen

• No payment amount restrictions

• Fully secure & officially compliant

• Includes Malaysian E-invoice for easy accounting & tax filing

• Avoid risk of account frozen

• No payment amount restrictions

• Fully secure & officially compliant

• Includes Malaysian E-invoice for easy accounting & tax filing

This is one of the best payment solutions for cross-border SMEs, offering a hassle-free, efficient, and secure procurement experience.

Service Comparison

Getting Malaysia Local Invoices

Our provided documents are legally accepted and recognized by Malaysian auditors.

Supporting Multiple MYR Payment Options

Top-up your wallet to reduce transaction hassles and enjoy better conversion rates.

Easy to Use

Place orders 24/7, track order progress at any time, and view the latest real-time exchange rates directly within the system.

How to Get Started?

Tutorial

Service Price List

- Higher conversion rate

- Minimum HANDLING FEE MYR 1

- Minimum transaction amount start from CNY 1 per order

- Maximum transaction amount is CNY 500,000 per order

Terms and Conditions

- The handling fee is 2% (include invoice), with a and the minimum charge is MYR 1.

- 1688 Angpau vourcher can;t be use here.

- Before placing your 1688 order, please take a moment to review our Prohibited Items List to avoid any issues with warehouse rejection due to the purchase of restricted goods. Any additional costs, such as goods return fees, will be the customer’s responsibility.

- During checkout, if the “SECURE PAYMENT” option appears on the payment page, you must select this method. If the option isn’t displayed, the system has automatically processed it and no further action is require.

- Each transaction will be processed according to the service-level agreement (SLA) of the selected service. Actual processing time may vary depending on our operational workflow.

- Customers need to log in to the system to view and download the payment slip. No separate notification will be sent once the payment is completed.

- If your supplier has not received payment after the transfer date, please contact us within 14 business days from the payment date; otherwise, the dispute request may no longer be traceable.

- MYR payment must be made before any fund transfers can be processed.

FAQ

Can't find the answer you're looking for? Contact us!

【1688 Payment】service is a secure and officially approved method — no risk of freezing, no transfer limit, and no need to top up your Alipay.

No. The “1688” we refer here is www.1688.com , which is a separate platform from the international Alibaba.com.

No. This service is exclusively for payments on www.1688.com. For other platforms, please refer to here.

First, register and activate your Exchange system account, then contact customer service and provide the following details:

Company name

Registered email address

Contact phone number

Our customer service team will assist you in setting up your dedicated sub-account within 24 hours.

For more details, please click here

Once payment is made, your supplier will begin preparing your order for delivery.CIEF do offers a variety of shipping solutions, including LCL Direct, LCL Consolidation, LCL with Tax Refund, Air Freight, Full Container Load (FCL), and more. To learn more about our shipping services, feel free to contact our customer service team by clicking here.