Bank Acceptance

Bank Acceptance is a financing instrument provided by banks that allows businesses to purchase goods first and repay the bank after 60 to 120 days, easing cash flow pressure.

CIEF can assist customers in utilizing their Bank Trade Facility (BA / Invoice Financing) credit lines to procure goods from China, simplifying the purchasing process.

Service Comparison

Getting Malaysia Local Invoices

Our provided documents are legally accepted and recognized by Malaysian auditors.

Enhance Cashflow Management

Enhance your company cashflow management

Easy to Use

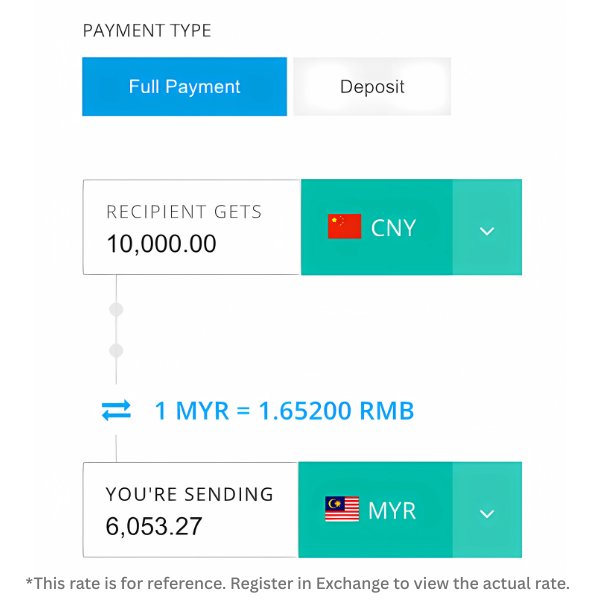

Place orders 24/7, track order progress at any time, and view the latest real-time exchange rates directly within the system.

How to Get Started?

Service Price List

- Higher conversion rate

- Minimum HANDLING FEE MYR 200

- Minimum transaction amount starts from MYR 10,000 per order

- Multiple payment methods to your supplier is supported

Terms and Conditions

- The handling fee is 2% (include issue invoice) , with a minimum charge is MYR 200.

- The minimum transaction amount is MYR 10,000.

- The rate subject to the rate on the day of bank disbursement.

- Each transaction will be processed according to the SLA of different services, and the specific payment processing speed depends on the actual operation of the company.

- Customers need to log in to the system to view and download the payment slip. No separate notification will be sent once the payment is completed.

- If your supplier has not received payment after the transfer date, please contact us within 14 business days from the payment date; otherwise, the dispute request may no longer be traceable.

- All remittance requests will only be processed after payment is received in CIEF.

FAQ

Can't find the answer you're looking for? Contact us!

Bank Acceptance is a financing instrument provided by banks that allows businesses to purchase goods first and repay the bank after 60 to 120 days, easing cash flow pressure.

No. You will need to consult your banker to apply for Bank Trade Facilities with your bank.

The bank only needs the supplier’s company name and SSM registration number. CIEF’s full name and SSM number are as follows:

CIEF WORLDWIDE SDN. BHD. (1134596-M)

First, ensure your bank has approved a Bank Acceptance (BA) facility. We only assist you in utilizing this facility for procurement—the credit line is provided by your bank, and our company does not issue any loans.

Once payment is made, your supplier will begin preparing your order for delivery.CIEF do offers a variety of shipping solutions, including LCL Direct, LCL Consolidation, LCL with Tax Refund, Air Freight, Full Container Load (FCL), and more. To learn more about our shipping services, feel free to contact our customer service team by clicking here.