In our previous article, the nature and origin of HS Code have been explained. We always receive inquiries from the clients, asking what is the HS Code corresponding to their commodities, and where they could find the HS Code. Today, we will provide a detailed tutorial in this article, showing you the way to search the commodity HS Code.

Method 1: Inquire the proxy transportation company you’ve chosen

Usually, the proxy transportation companies will help you in processing all the procedures, so do C.I.E.F. If you’re using C.I.E.F Full-Container Load (FCL) service, we will deal with the custom clearance-related business for you, all you need to do is provide us with the details of your commodity name and other particulars. Besides, the cost we have charged you is including the tariff and other related taxes, without any additional fee included.

1st step: Browse C.I.E.F official website, click on Full Container Load (FCL) price , then fill up your name and contact number. In order for our customer service to understand your request quickly, you may prepare the listed information and document. Our customer service will contact you and offer an exhaustive proposal for your Full Container Load (FCL) importing.

Method 2: Self-inquiry in the official portal

The easiest way is to search the commodity HS Code in Google. If you would like to know the more accurate HS Code for your commodity, you could browse the official portal of Royal Malaysian Customs Department and search the HS Code for the goods. However, please take note that the HS Code in the official website is only for reference, the accuracy is not assured. Instead, C.I.E.F can acquire the accurate HS Code for you through the official custom channel.

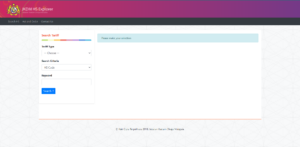

1st step: Browse the official portal of Royal Malaysian Customs Department .

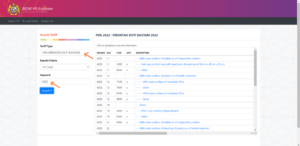

2nd step: Usually, we use “PDK 2017” to search the types of taxes. The keyword is the first 4 digits in the HS Code of your goods which is internationally unified. You could acquire these 4 digits in Google by searching the HS Code of the goods. Simply take a purse as an example, the first 4 digits in HS Code of purse is 4202, enter the required details, click on Search!!

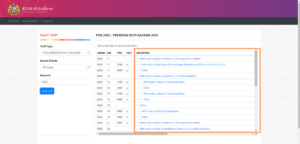

3rd step: Now, we can obtain the corresponding HS Code for the goods. As mentioned above, the HS Code is only for reference, it could not guarantee that this HS Code is appropriate for your commodity. So, we suggest that when you want to use either Full Container Load (FCL) or Less Than Container Load (LCL) service, do consult us ya ☺️

We believe that every importer knows that the import from China to Malaysia needs the import duty and SST. So, our next article will be a tutorial showing you how to search the corresponding import tariff to the commodities. Check it out now! How do Malaysian importers check their import tariff

Join us now by clicking the link below 👉🏼 Register account

⭐ Consolidation service: Airfreight, sea freight small parcel, sea freight big parcel 👉🏼 CIEF LITE

⭐ Sea shipping service: Full Container Load (FCL), Less than Container Load (LCL) 👉🏼 CIEF